Aitymbetova Ainurа Nurlanovna

Head of the chair by department "Finance"

Candidate of Economic Sciences, associate professor

Housing (HL), 433 office

Work Phone 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Aitymbetova Ainurа Nurlanovna

Head of the chair by department "Finance"

Candidate of Economic Sciences, associate professor

Housing (HL), 433 office

Work Phone 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Candidate of Economic Sciences, the professor

Contact information:

Housing (HL), 408 office

Work Phone 8 (7252) 21-14-01

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Candidate of Economic Sciences, assistant professor

Contact information:

Housing (HL), 437 office

Work Phone 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

PhD, Senior Lecturer

Contact information:

Housing (HL), 437 office

Work Phone 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Kandidat economic sciences, assistant professor

Housing (HL), 437 office

Work Phone 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Candidate of Economic Sciences, docent

Contact information:

Housing (HL), 437 office

Work Phone 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Candidate of Economic Sciences, Senior Lecturer

Contact information:

Housing (HL), 437 office

Work Phone 8 (7252) 21-23-67

E-mail: jasi.kz

Candidate of Sciences (Econ.), Associate Professor

Main building, room 437

Contact phone: 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Candidate of Economic Sciences, Senior Lecturer

Contact information:

Housing (HL), 437 office

Work Phone 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Doktor PHD

Main building, room 437

Contact phone: 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

MSc, Senior Lecturer

The main building, office 437

Phone number: 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Magister of finance, Senior Lecturer

Contact information:

Housing (HL), 437 office

Work Phone 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

PhD, Senior Lecturer

The main building, office 437

Work phone: 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Magister of finance, Senior Lecturer

Contact information:

Housing (HL), 437 office

Work Phone 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Magister of finance, Senior Lecturer

Contact information:

Housing (HL), 437 office

Work Phone 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Doctor PhD, Senior Lecturer

Main building, room 437

Contact phone: 8 (7252) 21-23-67

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Senior Lecturer

Magister of finance, Senior Lecturer

Contact information:

Housing (HL), 437 office

Work Phone 8 (7252) 21-23-67

E-mail: tan-nur @mail.ru

MSc, Lecturer

The main building, office 437

Phone number: 8 (7252) 21-23-67

E-mail: abilai--hanThis email address is being protected from spambots. You need JavaScript enabled to view it.

Tefcher

Contact information: Housing (HL), 437 officeWork

Phone 8 (7252) 21-23-67E-mail:

Department «Finance»

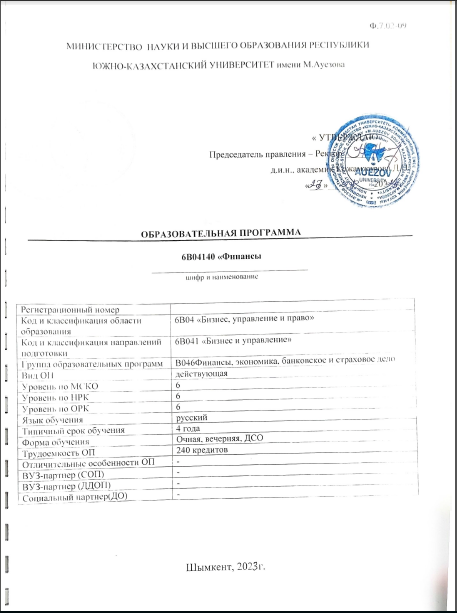

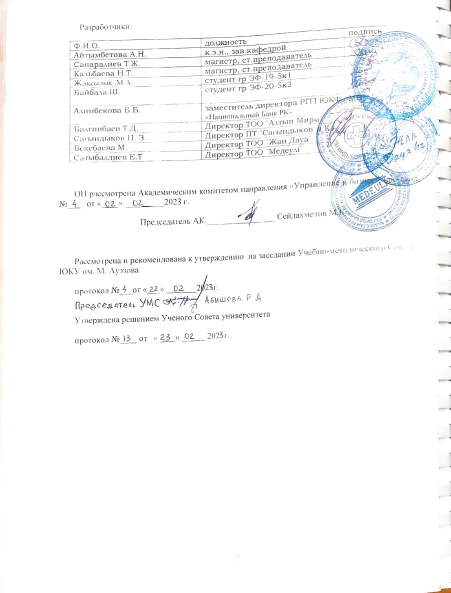

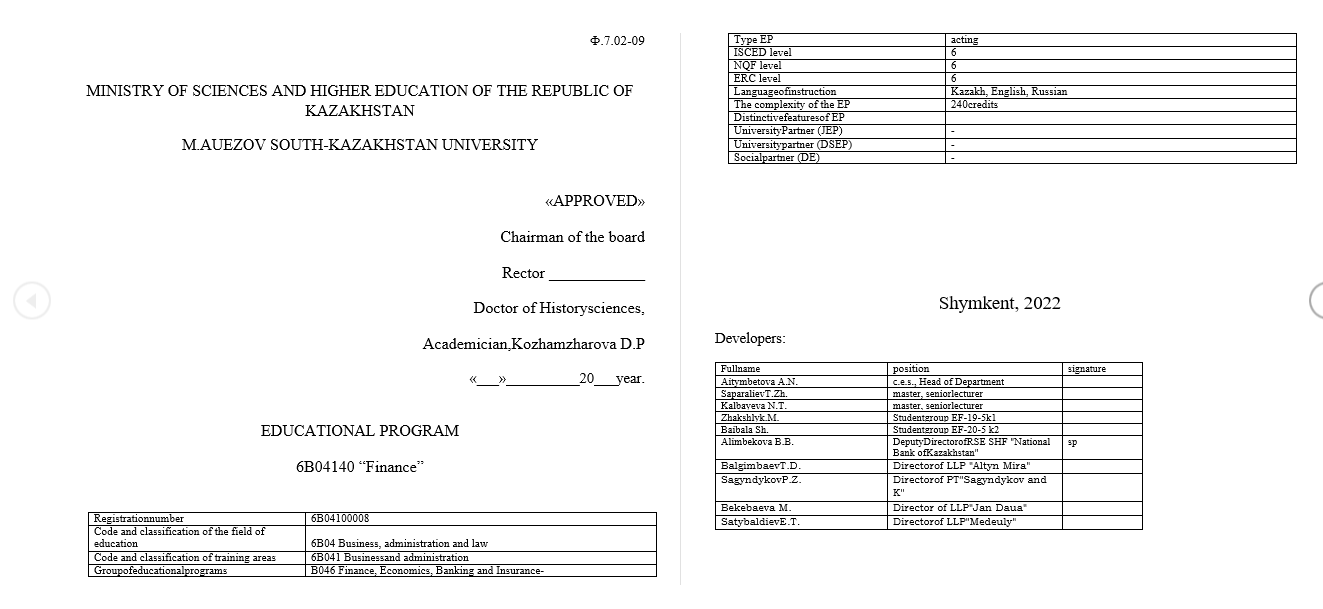

The Department «Finance and Credit» was founded on August 26, 1996.

The first graduation of financial specialists was carried out in 2000. In 2005, in order to improve and streamline the structure of departments, a reorganization was carried out. The department “Finance and Credit” was divided into two: “Banking” and “Taxes and Taxation”.

At different times, the departments were established by candidate of economic sciences, professor Sh.S. Bekibaeva, doctor of economic sciences, professor S.ZH. Zhakipbekov, candidate of economic sciences, docent Z.A. Bigeldieva. From 2018 to the present, the department is headed by A.N. Aitymbetova, candidate of economic sciences, associate professor.

The modern department “Finance” was formed in August 2014 through the merger of the departments “Banking” and “Taxes and Taxation” and is a structural unit of the High School “Management and Business” of M.Auezov South Kazakhstan University. The department has an experienced teaching staff, including 1 doctor of economic sciences, 3 professors, 9 candidates of economic sciences, 4 PhDs, 9 masters, who have extensive experience in teaching and practical activities.

Every year, the department graduates about 75-85 bachelor’s graduates in the educational program 6B04140 “Finance”, as well as 10-15 master’s graduates in the educational programs 7M04140/7M04142 Finance.” In 2021, the department developed and opened the doctoral educational program 8D04140 “Finance”. In 2023, applications for grants for training in this program are being accepted.

In general, over the entire period of professional activity, the department’s staff has trained more than 5,000 specialists who, after graduating from the university, successfully work in various spheres of the economy: financial, banking, tax spheres of the country, in production associations, insurance and investment companies, state and commercial enterprises.

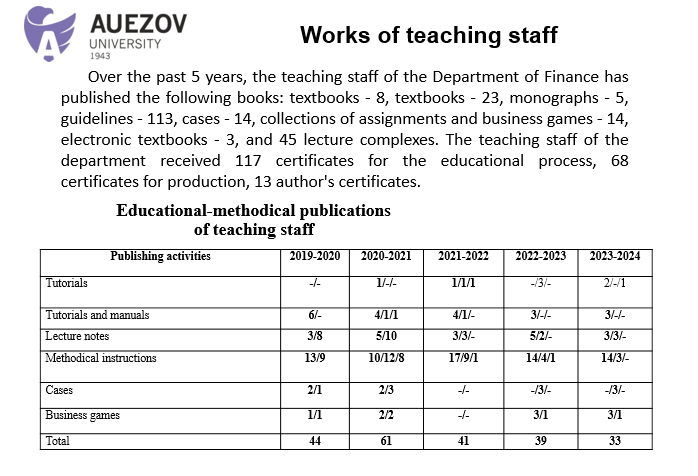

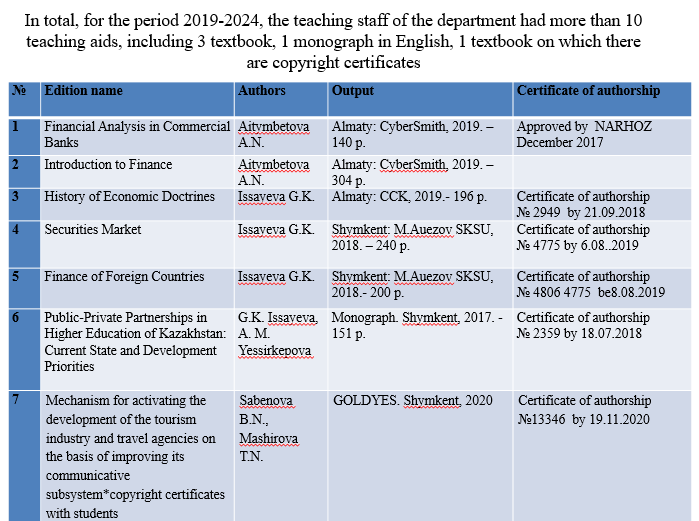

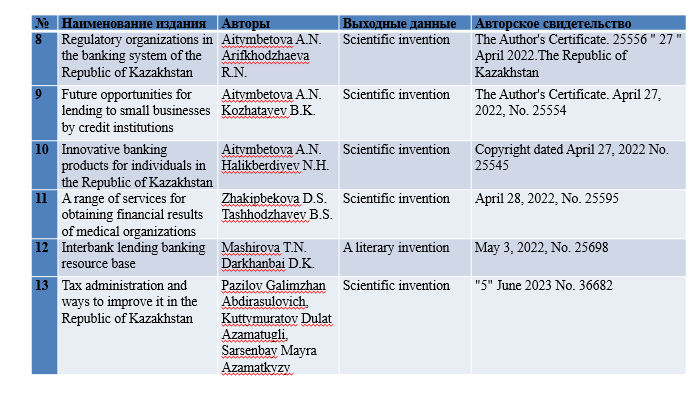

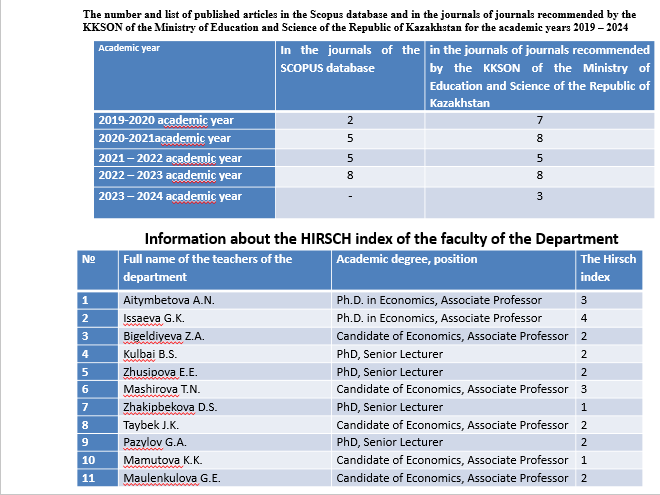

Teaching staff of the department actively participate in scientific research, in international and national conferences, over the last 3 years (since 2020) over 500 articles have been published in various scientific and practical journals, including: high-ranking international journals included in the SCOPUS databases, WoS, RSCI, journals recommended by Committee for Quality Assurance in the Field of Science and Higher Education of Ministry of science and higher education of the Republic of Kazakhstan, etc.

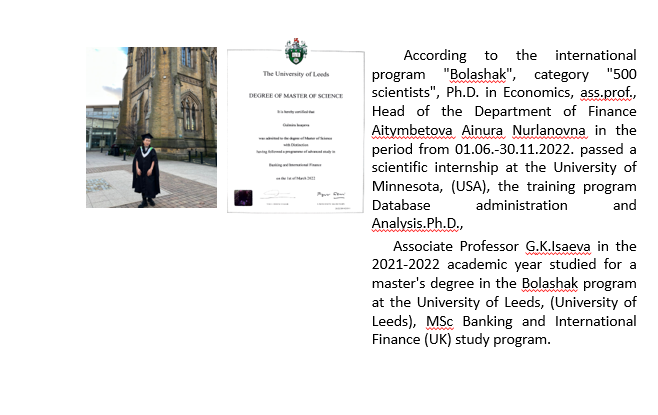

The teachers of the department are also actively involved in international cooperation projects in the form of scientific internships and academic training in foreign universities. So, according to the international program “Bolashak”, category “500 scientists”, candidate of economics, associate professors, head of the department “Finance” Aytymbetova Ainura Nurlanovna in the period from 01.06.-30.11.2022. Studied at the University of Minnesota, USA.

According to the international program “Bolashak”, the direction of study is master’s degree, candidate of economic sciences, professor of the department of “Finance” Isaeva Gulmira Kuzdeualievna in the period from 01.11.2021-01.31.2022. Studied at the University of Leeds, UK.

For the period from 2020-2023 more than 25 students of the Department «Finance» studied offline and online on external and internal academic mobility at universities in Kazakhstan, the Russian Federation, Poland, Turkey, etc.

The main goal of the staff of the Department «Finance» is to improve the quality of training of competent, competent, creative, competitive professionals who meet the modern level and criteria of the labor market, capable of independently improving their knowledge and skills.

- CONCEPT OF THE PROGRAM

|

UniversityMission |

Generation of new competencies, training of a leader who translates research and entrepreneurial thinking and culture |

|

UniversityValues |

• Openness–open to change, innovation and cooperation. • Creativity – generates ideas, develops them and turns them into values. • Academic freedom – free to choose, develop and act. • Partnership – creates trust and support in a relationship where everyone wins. • Social responsibility – ready to fulfill obligations, make decisions and be responsible for their results. |

|

GraduateModel |

• Deep subject knowledge, their application and continuous expansion in professional activity. • Information and digital literacy and mobility in rapidly changing conditions. • Research skills, creativity and emotional intelligence. • Entrepreneurship, independence and responsibility for their activities and well-being. • Global and national citizenship, tolerance to cultures and languages. |

|

The uniqueness of the educational program |

• Orientation to the regional labor market and social order through the formation of professional competencies of the graduate, adjusted to the requirements of stakeholders • Practical orientation and emphasis on the development of critical thinking and entrepreneurship, the formation of a wide range of skills that will allow to be functionally literate and competitive in any life situation and be in demand in the labor market |

|

Academic Integrity and Ethics Policy |

The University has taken measures to maintain academic integrity and academic freedom, protection from any kind of intolerance and discrimination: • Rules of academic integrity (Minutes of the Academic Council No. 3 dated 30.10.2018); • Anti-Corruption Standard (Order No. 373 n/k dated 27.12.2019). • Code of Ethics (Protocol of the Academic Council No. 8 dated 31.01.2020). |

|

Regulatory and legal framework for the development of EP |

1. Law of the Republic of Kazakhstan "On Education"; 2. Standard rules of activity of educational organizations implementing educational programs of higher and (or) postgraduate education, approved by Order of the Ministry of Education and Science of the Republic of Kazakhstan dated October 30, 2018 No. 595 with amendments and additions dated December 29, 2021 No. 614 3. State obligatory standards of higher and postgraduate education, approved by order of the Ministry of Education and Science of the Republic of Kazakhstan dated July 20.2022 No. 2; 4. Rules for organizing the educational process on credit technology of education, approved by order of the Ministry of Education and Science of the Republic of Kazakhstan dated April 20, 2011 No. 152; 5. Qualification directory of positions of managers, specialists and other employees, approved by order of the Minister of Labor and Social Protection of the Population of the Republic of Kazakhstan dated December 30, 2020 No. 553. 6. Guidelines for the use of ECTS. 7. Guidelines for the development of educational programs for higher and postgraduate education, Appendix 1 to the order of the Director of the Center for the Bologna Process and Academic Mobility No. 45 o / d dated June 30, 2021 |

|

Organization of the educational process |

• Implementation of the principles of the Bologna Process • Student-centered learning • Availability • Inclusivity |

|

Quality assurance of the Educational program |

• Internal quality assurance system • Involvement of stakeholders in the development of the Educational Program and its evaluation • Systematic monitoring • Actualization of the content (updating) |

|

Requirementsforapplicants |

It is established according to the Model Rules for admission to training in educational organizations, implementing educational programs of higher and postgraduate education, Order of the Ministry of Education and Science of the Republic of Kazakhstan No. 600 dated 31.10.2018 |

|

Conditions for the implementation of educational programs (EP) for persons with disabilities and special educational needs(SSN) |

For students with SEN (special educational needs) and persons with disabilities (PSI), tactile PVC tiles, specially equipped toilets, a mnemonic diagram, and shower bars have been installed in educational buildings and student dormitories. Special parking spaces have been created. Crawler lift installed. There are desks for people with limited mobility (PLM), signs indicating the direction of movement, ramps. In the educational buildings (main building, building No. 8) there are 2 rooms with six working places adapted for users with disorders of the musculoskeletal system (DMS).For visually impaired users, the SARA™ CE Machine (2 pcs.) is available for scanning and reading books. The library website is adapted for the visually impaired. There is a special NVDA audio program with a service. The JIC website http://lib.ukgu.kz/ is open 24/7. An individual differentiated approach is provided for all types of classes and in the organization of the educational process. |

2.EP PASSPORT

|

PurposeoftheEP |

Preparation of competitive bachelor-financiers with theoretical and practical knowledge, necessary methods and tools, who are able to evaluate and analyze the current state of development of the financial sector. |

|

Objectives of the EP:

|

- the formation of socially responsible behavior in society, an understanding of the significance of professional ethical norms and the adherence to these norms; - providing basic undergraduate training that allows you to continue learning throughout life, to successfully adapt to changing conditions throughout their professional careers; - ensuring conditions for acquiring a high general intellectual level of development, mastering competent and developed speech, a culture of thinking and skills of scientific work organization in the field of finance and entrepreneurship, management and organization of finance of enterprises of various forms of ownership; - creation of conditions for intellectual, physical, spiritual, aesthetic development to ensure the possibility of their employment in the specialty or continuing education at subsequent levels of education. |

|

EP harmonization |

• Level 6ofthe National Qualifications Framework oftheRepublicofKazakhstan; • Dublin Descriptors 6 skilllevels; • 1st cycleoftheQualification Framework ofthe European Higher Education Area (A Framework forQualificationofthe European Higher Education Area); • Level 6of The European Qualification Framework forLifelong Learning. |

|

Communication ofthe EP withthe professional sphere |

EP complies with professional standards: Industry qualifications framework for innovation.Professional standard: "Financial management" order No. 263. from 26.12.2019 . Professional standard: "financing of an innovative project" order No. 259 of 24.12.2019 . Industry qualifications framework for small and medium-sized businesses (cross-cutting professions).Professional standard: "Risk management" order No. 263 of 26.12.2019 . Industry qualifications framework for small and medium-sized businesses (trade) . Professional standard: "management of a small (medium-sized company)" order No. 263. from 26.12.2019 . Professional standard: "activities of agents engaged in wholesale trade in exchange-traded goods" order No. 266 of 27.12.2019 . |

|

List ofqualificationsandpositions |

The graduate of this EP is awarded the degree of "Bachelor of business and management on Educational Program 6B04140 "Finances" Bachelors of the educational program 6B04140 “Finance” may hold primary positions as a leading and chief specialist in finance, as well as positions of credit manager, financial analyst in government bodies of the republican, regional and local level, second-tier banks, stock exchanges, insurance companies, investment funds, the Ministry of Finance Kazakhstan, the National Bank of Kazakhstan, in enterprises and organizations of various forms of ownership. |

|

Sphere of professional activity |

The sphere of professional activity is the area in which graduates carry out financial and analytical, insurance, investment, management, tax control and other professional activities in relevant organizations and / or institutions. |

|

Objects of professional activity |

the Ministry of Finance of the Republic of Kazakhstan, the Ministry of National Economy of the Republic of Kazakhstan, the National Bank of Kazakhstan, financial and economic services of Ministries and Agencies, second-tier banks, insurance, pension, leasing companies, pawnshops, credit partnerships, stock exchanges, budget institutions and organizations, investment funds, economic entities of various organizational and legal forms, economic courts. |

|

Subjects of professionalactivity |

- analytics and compilation of consolidated financial statements of second-tier banks of the Republic of Kazakhstan; - investment and portfolio management of individuals and legal entities; - drawing up the reporting and contracts of participants of the insurance market; - conducting financial planning and forecasting in the implementation of business projects; - the preparation and maintenance of contracts and other documentation accompanying the credit process in the second-tier banks. |

|

Types of professional activity |

- organizational and managerial; -calculated design; - experimental research; -economic; -analytical; -consultation |

|

Learning outcomes in EP

|

LO1Communicate freely in a professional environment and society in Kazakh, Russian and English, taking into account the principles of academic writing with a culture of academic honesty LO2Demonstrate social, natural-science, socio-cultural, professional development, based on the formation of ideological, civic and spiritual positions and methods of scientific and experimental research LO3 Demonstrate informational, analytical and computational literacy through the generalization and analysis of information, including in the field of financial and economic relations. LO4 Possess fundamental economic knowledge in the field of organization of money circulation and finance, the foundations of the organization and functioning of the financial system of the country as a whole, its individual areas and links. LO5 Use domestic and foreign experience in the field of finance and credit, analyze data on the structure, subjects, patterns and dynamics of the processes of the modern financial system. LO6 Apply methods of tax and budget planning and calculation of all types of taxes, fees and other government payments to the budget of the Republic of Kazakhstan. LO7 To carry out consultations in the field of banking and insurance business. Be able to assess the creditworthiness of potential borrowers. Determine the main trends in the use of digital financial technologies, substantiating the essence of financial and credit operations. LO8 Make effective managerial decisions on the use of marketing and financial and economic tools at enterprises, in organizations of the public and private sectors of the economy. LO9 Apply basic approaches in the management and content of financial planning, investment projects, business plans, long-term and current plans of enterprises and the state. LO10 Use research, entrepreneurial and risk management skills. Be able to build work independently and as a member of a team, adjust your deadlines and actions, focus on professional success.

|

3.COMPETENCES OF THE GRADUATE OF EP

|

SOFTSKILLS.Behavioralskillsandpersonalityqualities |

|

|

SS1. Competenceinmanagingone'sownliteracy |

SS1.1.The abilityofself-learn, self-developandconstantly update theirknowledgewithinthechosentrajectoryand in an interdisciplinaryenvironment. SS1.2. The abilitytoexpressthoughts, feelings, factsandopinions in the professional field. SS1.3. The abilityformobility in the modern worldandcriticalthinking. |

|

SS 2. Languagecompetence |

SS2.1.Theabilitytobuildcommunicationprograms in thestate, Russianandforeignlanguages. SS2.2. The abilityfor interpersonal socialand professional communication in theconditionsofinterculturalcommunication. |

|

SS 3. MathematicalCompetenceandCompetenceinthe field of Science |

SS3.1.Theabilityandwillingnesstoapplytheeducational potential, experienceand personal qualitiesacquiredduringthestudyofmathematical, naturalscience, technicaldisciplinesattheuniversitytosolve professional problems. |

|

SS 4. Digitalcompetence, technologicalliteracy |

SS4.1. The ability to demonstrate and develop information literacy through the mastery and use of modern information and communication technologies in all areas of their lives and professional activities. SS4.2. The ability to use various types of information and communication technologies: Internet resources, cloud and mobile services for searching, storing, protecting and disseminating information. |

|

SS 5. Personal, socialandacademiccompetencies |

SS5.1.The ability for physical self-improvement and focus on a healthy lifestyle to ensure full-fledged social and professional activities through the methods and means of physical culture. SS5.2. The aility to social and cultural development based on the manifestation of citizenship and morality. SS5.3 The ability to build a personal educational trajectory throughout life for self-development, career growth and professional success. SS5.4. The ability to successfully interact in a variety of socio-cultural contexts during study, work, home and leisure. |

|

SS 6. Entrepreneurialcompetence |

SS6.1. The abilitytobecreativeandentrepreneurial in a varietyofenvironments. SS6.2. The abilitytowork in a modeofuncertaintyandrapidlychangingtaskconditions, makedecisions, allocateresourcesand manage your time. SS6.3. The abilitytoworkwithconsumerrequests. |

|

SS 7. Culturalawarenessandabilitytoexpressyourself |

SS7.1. The abilitytoshowworldview, civilandmoralpositions. SS7.2. The abilitytobe tolerant ofthetraditionsandcultureofotherpeoplesoftheworld, tohave high spiritual qualities. |

|

PROFESSIONAL COMPETENCES (HARDSKILLS). |

|

|

Theoretical knowledge and practical skills specific to this area |

PC-1 the ability to analyze and interpret financial, accounting and other information contained in the statements of enterprises of various forms of ownership, organizations, departments and use the information obtained for making management decisions |

|

PC-2 the ability to carry out the development and implementation of recommendations to improve the financial and economic activities of enterprises and organizations, as well as government bodies and local governments |

|

|

PC-3 - the ability to analyze the activities of second-tier banks based on financial statements, indicators for the further efficient management of a commercial bank in the current market economy conditions; |

|

|

PC-4 - the ability to distinguish and understand the main approaches of tax planning and financing of budget expenditures (estimated funding, regulatory funding, performance budgeting, performance budgeting, etc.) |

|

|

PC-5 - the ability to analyze and evaluate the development of the financial market of Kazakhstan, the conditions of the modern investment climate, to form an income portfolio of securities. |

|

3.1 Matrix of correlation of learning outcomes for the EP as a whole with the formed competencies of the modules

|

LO1 |

LO2 |

LO3 |

LO4 |

LO5 |

LO6 |

LO7 |

LO8 |

LO9 |

LO10 |

|

|

SS1 |

+ |

+ |

|

+ |

|

|

|

|

|

|

|

SS2 |

+ |

|

+ |

|

+ |

|

|

|

|

|

|

SS3 |

|

+ |

+ |

|

|

+ |

+ |

+ |

|

+ |

|

SS4 |

|

+ |

+ |

|

|

|

+ |

|

|

+ |

|

SS 5 |

+ |

+ |

|

|

+ |

|

+ |

+ |

+ |

|

|

SS6 |

|

|

|

+ |

+ |

+ |

+ |

+ |

+ |

+ |

|

SS7 |

+ |

+ |

|

|

+ |

|

|

|

|

|

|

PC 1 |

|

|

+ |

|

|

+ |

+ |

+ |

|

|

|

PC 2 |

|

|

|

|

+ |

+ |

|

|

+ |

+ |

|

PC 3 |

|

|

|

|

+ |

+ |

+ |

|

|

|

|

PC 4 |

|

+ |

+ |

|

+ |

+ |

+ |

+ |

+ |

+ |

|

PC 5 |

|

|

|

|

+ |

+ |

+ |

+ |

+ |

+ |

4.MATRIX OF THE INFLUENCE OF DISCIPLINES ON FORMATION OF LEARNING OUTCOMES AND INFORMATION ON LABOR INTENSITY

|

№ |

Module name |

CYCLE |

Component |

Discipline Name |

Brief course description |

Number of credits |

|

||||||||||

|

LО1 |

LО2 |

LО3 |

LО4 |

LО5 |

LО6 |

LО7 |

LО8 |

LО9 |

LО10 |

|

|||||||

|

1

2 |

SocialSciencesModule |

GCS |

|

HistoryofKazakhstan |

The purpose of the discipline isformation of an objective idea of the history of Kazakhstan based on a deep understanding and scientific analysis of the main stages, patterns and originality of the historical development of Kazakhstan. TheContent.Ancient people and the formation of nomadic civilization. Turkic civilization and the great steppe. Kazakh Khanate. Kazakhstan in the era of modern times. Kazakhstan as part of the Soviet administrative-command system. Declaration of Independence of Kazakhstan. State system, socio-political development, foreign policy and international relations of the Republic of Kazakhstan. Methods and techniques of historical description for the analysis of the causes and consequences of events in the history of Kazakhstan. |

5 |

|

ѵ |

|

|

|

|

|

|

|

|

|

|

GCS |

|

Philosophy |

Purpose.The formation of a holistic idea among students about philosophy as a special form of knowledge of the world, about its main sections, problems and methods of studying them in the context of future professional activity. And also the formation of philosophical reflection, introspection and moral self-regulation among students. Contents.Emergence of a culture of thinking. Subject and method of philosophy. Fundamentals of philosophical understanding of the world: questions of consciousness, spirit and language. Being. Ontology and metaphysics. Cognition and creativity. Education, science, technology and technology. Human philosophy and the world of values. Ethics. Philosophy of values. The subject of aesthetics as a field of philosophical knowledge. Philosophy of freedom. Philosophy of art. Society and culture. Philosophy of history. Philosophy of religion. "Mangіlіk El" and "Modernization of Public Consciousness" are a new Kazakhstan philosophy |

5 |

|

ѵ |

|

|

|

|

|

|

|

|

|

||

|

3

4 |

Socio-politicalknowledgemodule |

GCS |

|

SocialandPoliticalStudies |

The goal of forming knowledgeabout social and political activities, explaining social and political processes and phenomena. Content.Consideration of the system of socio-ethical values of the society. Ways to use social, political, cultural, psychological institutions, features of youth policy in the modernization of Kazakhstani society and solve conflict situations in society and professional environment based on them. To study the methods of analysis and interpretation of political institutions and processes, ideas about politics, power, state and civil society, to understand and use the methods and methods of sociological, comparative analysis, to understand the meaning and content of the political situation in the modern world. Analysis and classification of the main political institutions. |

4 |

|

ѵ |

|

|

|

|

|

|

|

|

|

|

GCS |

|

CulturalStudiesandPsychology |

Purpose: the formation of scientific knowledge of history, modern trends, current problems and methods for the development of culture and psychology, the skills of a systematic analysis of psychological phenomena. Contents: Morphology, language, semiotics, anatomy of culture. Culture of nomads, proto-Turks, Turks. Medieval culture of Central Asia. Kazakh culture at the turn of the XVIII - XIX centuries, XX century. Cultural policy of Kazakhstan. State Program "Cultural Heritage". National consciousness, motivation. Emotions, intellect. The will of man, the psychology of self-regulation. Individual typological features. Values, interests, norms are the spiritual basis. The meaning of life, professional self-determination, health. Communication of the individual and groups. Socio-psychological conflict. Models of behavior in conflict. |

4 |

|

ѵ |

|

|

|

|

|

|

|

|

|

||

|

5

6

7

8

|

Socio-EthnicDevelopmentModule |

GCS

|

UC |

EcosystemandLaw |

The purpose:Formation of integrated knowledge in the field of economics, law, anti-corruption culture, ecology and life safety, entrepreneurship, scientific research methods. Content:Fundamentals of safe human-nature interaction, ecosystem and biosphere productivity. The entrepreneurial activity of society in conditions of limited resources, increasing the competitiveness of business and the national economy. Regulation of relations in the field of ecology and human life safety. Knowledge and compliance of Kazakhstan’s law, obligations and guarantees of subjects, state regulation of public relations to ensure social progress. Application of scientific researchmethods. |

5 |

|

ѵ |

|

|

|

|

|

|

|

|

|

|

BD |

UC |

AbayStudy |

Purpose: based on the creativity of A.Kunanbayev, the preservation of the «national code» and in the project «Kazakhtanu» Contents: historical overview of the history of Kazakhstan and Kazakh literature of the XIX-XX centuries. Studies of Abai's legacy of the XX-XXI century. Chronology of Abai's creativity. Abai is a great poet, ethnographer, founder of Kazakh written literature. Abai is the compiler of the code of laws «The Position of Karamola», social significance. Abai is a thinker, religious scholar, philosopher. The role of Abai in education and science, the concept of a «Holistic person». «Words of Edification»by Abai, an epic novel by M.Auyezova«The Way of Abai» . K. Tokayev«Abai and Kazakhstan in the XXI century», role, significance. |

3 |

|

ѵ |

|

|

|

|

|

|

|

|

|

||

|

BD |

UC |

MukhtarStudy |

Purpose: Formation of a historical, literary idea of M. Auezov's work in the context of literary history, patriotism and cultural and spiritual position. Development of artistic thinking, skills of independent research activity. The content of the discipline The life and creative path of M. Auezov Semipalatinsk, Tashkent, St. Petersburg periods. M. Auezov's activity in the magazines «Sholpan», «Abai». M. Auezov's journalism. An artistic review of the short stories "Korgansyzdyn kuni", "Kyr suretteri", "Okagan azamat", "Kokserek", the play Enlik-Kebek and the stories "Kili Zaman", "Karash-Karash" okigasy", the monograph "Abai Kunanbayev", the epic novel "Abai Zholy". |

|

ѵ |

|

|

|

|

|

|

|

|

|

|||

|

BD |

ED |

Actual Problems and Modernization of National Awareness |

The purpose of the discipline is the restoration of spirituality, deformed during the periods of tsarist and Soviet reality, the formation of a creative personality based on the modernization of the public consciousness of young people. The Content.Spiritual modernization: origin and background. Modern national identity. Pragmatism and competitiveness. National identity and national code. Experience and prospects of evolutionary development. The triumph of knowledge and openness of consciousness. Alphabet Reform: Experience and Priorities. Fatherland is the basis of the state. Education through nationwide sacred places and history. Modern Kazakh culture is the cornerstone of spiritual revival. New humanitarian education and the future national intelligentsia. Abai Kunanbaev and Kazakh society.

|

|

ѵ |

|

|

|

|

|

|

|

|

|

|||

|

|

|

BD |

ED |

Foundations of Anticorruption Culture |

Purpose: formation of an anti-corruption worldview, strong moral foundations of a personality, civic position, stable skills of anti-corruption behavior. Content: Overcoming legal nihilism, formation of the basics of students' legal culture in the field of anti-corruption legislation. Formation of a conscious perception/attitude towards corruption.Moral rejection of corrupt behaviour, corrupt morality and ethics.Development of skills necessary to fight corruption.Development of anti-corruption standards of conduct.Anticorruption propaganda, dissemination of lawfulness and respect for the law. Activities aimed at understanding the nature of corruption, awareness of social damage caused by its manifestation, ability to defend one's position with arguments, seeking ways to overcome manifestation of corruption. |

|

|

ѵ |

|

|

|

|

|

|

|

|

|

|

|

|

BD |

ED |

Service to society |

The aim is the formation of socially significant skills and competencies in students based on the assimilation of academic programs, carrying out socially useful activities related to the disciplines studied at the university. Content. The concept and meaning of Service learning, the history of the formation and development of the concept of Service Learning. Key components of Service Learning, socially useful activities in the children's and youth environment, organization of volunteer movement in the world and Kazakhstan practice, profile orientation of Service Learning. International practice of learning through socially useful activities. General principles and methodology for the development of social projects. Methods of analysis of implemented social projects. |

|

|

ѵ |

|

|

|

|

|

|

|

|

|

|

9

10

11

12

13

14

|

Communication and physical education module |

GCS |

|

Kazakh (Russian) Language |

Purpose: formation of communicative competence using the Kazakh (Russian) language in the socio-cultural, professional and public life, improvement of the ability to write academic texts. The contents. Levels А1, А2, В1, В2-1, В2-2 (В2, С1 Russian language) are presented in the form of cognitive-linguocultural complexes, consisting of spheres, themes, sub-themes and typical situations of communication of the international standard: social, social - cultural, educational and professional, modeled by forms: oral and written communication, written speech works, listening. Demonstration of understanding of the language material in the texts on the educational program, knowledge of terminology and development of critical thinking. |

10 |

ѵ |

|

|

|

|

|

|

|

|

|

|

|

GCS |

|

ForeignLanguage |

The aimis a formation of students' intercultural and communicative competence in the process of foreign language education at a sufficient level A2 and a level of basic sufficiency B1. Student reaches B2level of common European competence if the language level at the start is higher than B1level of common European competence The contents. Levels A1, A2, B1, B2 are presented in the form of cognitive-linguocultural complexes, consisting of spheres, themes, sub-themes and typical situations of international standard’scommunication: social, social - cultural, educational and professional, modeled by forms: oral and written communication, written speech works, listening.Demonstration of language material’sunderstanding in texts on educational program, knowledge of terminology and critical thinking development |

10 |

ѵ |

|

|

|

|

|

|

|

|

|

|

||

|

GCS |

|

PhysicalTraining |

Objective: the formation of social and personal competencies and the ability to purposefully use the means and methods of physical culture that ensure the preservation and strengthening of health in preparation for professional activity; to the persistent transfer of physical exertion, neuropsychic stresses and adverse factors in future work. Content.Implementation of physical culture and health and training programs. A complex of general development and special exercises. Sports. Control and self-control during classes, insurance and self-insurance. Refereeing competitions, Means of professionally applied physical training. Modern health-improving systems: the breathing system according to A. Strelnikova, K. Buteyko, K. Dinaiki, joint gymnastics according to Bubnovsky.. |

8 |

|

|

|

|

|

|

|

|

|

ѵ |

|

||

|

BD |

UK |

ProfessionalKazakh (Russian) Language |

Goal: to provide professionally oriented language training of a specialist who is able to competently construct communication in professionally significant situations and speak the language norms for special purposes. Content:Professional language and its components. Professional terminology as the main feature of scientific style. Scientific vocabulary and scientific constructions in educational-professional and scientific-professional spheres. Algorithm of work on the analysis and production of scientific texts on specialty. Producing scientific and professional texts. Basics of business communication and documentation within the framework of future professional activity. |

3 |

ѵ |

|

|

|

|

|

|

|

|

|

|

||

|

BD |

UK |

ProfessionallyOrientedForeignLanguage |

Goal: Mastery of competencies that allow further use of a foreign language in various areas of professional development and mastery of professional terms in the field of economics. Contents: Economic environment. Factors affecting the economic environment. Economy and integration. Principles of marketing and management. Fundamentals of doing business and entrepreneurship. Logistics and advertising. Functions of money and sources of profit formation. Financial system and its components. Types of financial transactions. budget system. Banking system. Theory and organization of taxation. International trade policy. European monetary policy. International trade. Distribution channels and logistics. |

3 |

ѵ |

|

|

|

|

|

|

|

|

|

|||

|

GCS |

|

Information and Communication Technologies |

Purpose: formation of the ability to critically evaluate and analyze processes, methods of searching, storing and processing information, methods of collecting and transmitting information through digital technologies. Development of new "digital" thinking, acquisition of knowledge and skills in the use of modern information and communication technologies in various activities Contents: Introduction and architecture of computer systems. Software. Operating systems. Human-computer interaction. Database systems. Data analysis. Data management. Networks and Telecommunications.Cybersecurity. Internet technologies. Cloud and Mobile technologies. Multimedia technologies. Smart technology. E-technologies. Electronic business. Electronic government. |

5 |

|

|

ѵ |

|

|

|

|

|

|

|

|

||

|

15

16

17

18

19

20

|

Module of the basics of economic and mathematical training |

BD |

UС |

MathematicsinEconomy |

Purpose: Formation of students' skills in constructing a mathematical model of economic problems and ways to solve it. Contents: The basic fundamental concepts of mathematics in economics are explained: matrices and determinants, systems of linear algebraic equations and inequalities, vectors and operations applied to them, differential calculations in economic analysis, economic and mathematical modeling, applied mathematical models, resource efficiency, ways to solve transport problems, models for building business plans, basic concepts of probability theory and mathematical statistics, elements of correlation and regression analysis |

4 |

|

|

ѵ |

ѵ |

|

|

|

|

|

|

|

|

BD |

UС |

EconomicTheory |

Purpose: formation of a system of knowledge about the economic patterns of the development of society and the problems of its effective functioning. Contents: Economy as a sphere of society's life. Social production. Property relations and their role in the economy. Forms of social economy. Market as a system of economic relations. Theory of supply and demand. Entrepreneurship. production costs. The essence of capital and its types. factors of production. National economy. Aggregate demand and aggregate supply. Cyclical development of the economy. Unemployment and inflation. Financial and monetary policy. Fiscal policy of the state. Social policy, its directions and functions. Worldeconomy. |

4 |

|

|

ѵ |

ѵ |

|

|

|

|

|

|

|

||

|

BD |

ED |

IntroductiontoSpecialty |

Purpose: to obtain cumulative knowledge of the theoretical aspects of finance and credit, the fundamentals of the functioning of the monetary, financial, budgetary and tax systems of the state and enterprises. Contents: Essence and functions of money. Money circulation and monetary systems. credit system. Theory and organization of finance. Organization of the financial system of the Republic of Kazakhstan. State financial policy. Banks and their role in the economy. The role and functions of the state budget. Functions of taxes. The role of the banking system of the Republic of Kazakhstan. Components of the financial market. Significance and branch of insurance. |

4 |

|

ѵ |

|

ѵ |

|

|

|

|

|

|

|

||

|

BD |

ED |

FundamentalsofAcademicWriting |

The purpose of the course is the formation of professional competence and the expansion of communicative competence related to analytical textual activity; the formation of students' skills of linguistic and pragmatic thinking, the ability to analyze the expressive units of the language and competently select the desired unit depending on the goals and conditions of communication Contents. The main genres of academic writing (abstract, review, analytical review, scientific report). Scientific databases: rules for compiling a search query, keyword search, Domestic and foreign databases. Search through Amazon catalogs, domestic and foreign scientific publishers. The structure of the academic community: scientific centers, publishing houses, journals. Orientation in the modern academic space. Rules for compiling a bibliographic description. |

|

ѵ |

|

ѵ |

|

|

|

|

|

|

|

|||

|

BD |

UС |

Microeconomics AndMacroeconomics |

Purpose: study of methods and models of microeconomics and macroeconomics, for an objective assessment of the behavior of subjects of a market economy and successful self-realization of students in a business environment Contents: Market mechanism, supply and demand analysis. Theory of consumer behavior. Theory of production. Production costs. The behavior of the firm in conditions of perfect, monopolistic competition, oligopoly and monopoly. Factor of productionmarkets. External effects. Public goods. Macroeconomic indicators. Economic cycles, unemployment, inflation. Aggregate demand and aggregate supply. Consumption and savings. Money market. Model IS-LM. The economic growth. International trade. Payment balance. Exchange rate. |

5 |

|

|

|

ѵ |

|

|

|

|

|

|

|

||

|

BD |

UС |

EducationalPractice |

The purpose of the educational (introductory) practice of students of higher educational institutions is the acquisition of primary professional competencies, including the consolidation and deepening of theoretical knowledge gained in the learning process, the acquisition of the first skills of research, the skills of conducting business correspondence, the acquisition of practical skills and work skills in accordance with specialty of study. Content Educational practice is carried out in terms corresponding to the curriculum. The duration of the training practice is 1 week. Before the practice, the Department of Finance holds an introductory conference to clarify the purpose, objectives and content of the work, each student is given a program, a diary and an individual task. |

1 |

|

|

ѵ |

|

|

|

|

|

|

ѵ |

|||

|

21

22

23

24

25

26

|

Management and business basics module |

BD |

UС |

Management |

Purpose: Forming management skills in the organization, develop leadership and managerial qualities Contents: Evolution, basic concepts and schools of management. Theory of organization and its development. Methodological foundations of management. Formation and development of the team. Internal and external environment. The qualities of a manager and his role in the organization. Leadership: leadership style and image of a manager. Assessment of the competitiveness of the organization. Entrepreneurship and management. Information and communication management support. Development of management solutions. Managing conflicts, stresses and changes. Culture of management activity. Management functions. Managementeffectiveness |

4 |

|

|

|

|

|

|

|

ѵ |

ѵ |

|

|

|

BD |

ED |

State Regulation of the Economy |

The purpose of the program is to familiarize students with the principles of the functioning of the modern economy, to study the mechanisms of the market and the ways in which the state influences the functioning of the economy. Contents:Theoretical and methodological foundations of state regulation of the economy.. General characteristics of forms of state regulation. Forecasting and strategic planning as the main methods of state regulation of the economy. Fiscal methods of regulating the economy. The main mechanisms of monetary regulation of the economy. Scientific and technological progress and the role of the state in its acceleration. Formation and mechanisms of implementation of the structural, industrial and investment policy of the state. State regulation of the agricultural sector. State regulation of employment and social protection of the population. |

4 |

|

|

|

|

|

|

|

ѵ |

ѵ |

|

|

||

|

BD |

ED |

Marketing |

The purpose of the discipline is learning the theoretical foundations, conceptual apparatus of marketing, mastering practical skills in the application of elements and principles of marketing in companies activity. ContentTheoretical foundations of marketing. Marketing management. Marketing research and marketing information. Marketing environment. Markets and consumer buyer behavior. Market segmentation and product positioning. Development of goods and new products, product policy strategies. Tasks, pricing policy; pricing strategies. Distribution channels and logistics. Communication and incentive strategy. Product promotion, communication policy. Strategy, planning, control. International marketing. Marketing of services and marketing in the field of non-profit activities. |

|

|

|

|

|

|

|

ѵ |

|

|

|

|||

|

BD |

UC |

EconomyofEnterprise |

The purpose of the discipline is the development of students' economic thinking based on the study of the economic mechanism of enterprise functioning in market conditions. Contents The enterprise as an object of management, the main link of the economic system. Entrepreneurial activity of the enterprise. The fixed capital of the enterprise. The working capital of the enterprise. The material resources of the enterprise and the efficiency of their use. The labor resources of the enterprise. Labor payment at the enterprise. Investment and innovation activity of the enterprise. Planning of the production activity of the enterprise. Marketing activity of the enterprise. Competitiveness of products and enterprise. Production and sales costs. Financial results of the enterprise's activity. Enterprise’s finance. Economic efficiency of the enterprise’s activity. |

4 |

|

|

|

|

|

|

|

ѵ |

ѵ |

|

|

||

|

BD |

ED |

Entrepreneurship |

The purpose of the discipline is training to theoretical bases and practical skills of the organization in entrepreneurial activities of enterprises in a competitive environment. Contents. Entrepreneurship: essence, contents and conditions of formation. Legal forms of entrepreneurship. Risks in entrepreneurship. Business planning in entrepreneurship. Financing of entrepreneurial activity. Staffing of entrepreneurial activity. Organization of entrepreneurial transactions. Entrepreneurial secret and ways of its protection. Responsibility of business entities. Culture and ethics of entrepreneurship. The competition and competitiveness in the sphere of entrepreneurship. Analysis and assessment of efficiency of entrepreneurial activity. Small entrepreneurship. State support of entrepreneurship and its infrastructure. Termination of entrepreneurial activity. |

4 |

|

|

|

|

|

|

|

|

ѵ |

ѵ |

|

||

|

BD |

ED |

OrganizationofEntrepreneurialActivity |

The purpose of the discipline is the formation of knowledge and practical skills in the field of organization of effective entrepreneurial activity, including legal and organizational-economic relations in building a business. Contents.Theoretical foundations of entrepreneurship. The main forms of modern entrepreneurship. The main types of modern entrepreneurship. An entrepreneurial idea and its choice. Creation and organization of entrepreneurial activity. The choice of the organizational and legal form of doing business. Entrepreneurial capital. The institutional environment of the functioning of entrepreneurial activity. Formation of an effective organization of entrepreneurial activity. Efficiency of entrepreneurial activity. Business valuation and company restructuring. |

|

|

|

|

|

|

|

|

ѵ |

ѵ |

|

|||

|

27

28

29

30

31

32 |

Fundamentals of Accounting and Finance Module |

BD |

UC |

Finance |

Purpose: to study the fundamentals of the theory and practice of finance and to form students' understanding of the financial, currency, monetary, and other constituent elements of the country's financial system. Contents: Essence and functions of finance. The structure of the financial system. financial mechanism. Financial management tools. Forms and methods of financial control. Forms of public credit. Household finance. Significance and branch of insurance. The role of the budget and the budget device. Functions of the state budget. Appointment and classification of off-budget funds. Functions of off-budget funds. Financial planning and forecasting. Finance foreign economic relations. Finance and inflation. |

4 |

|

|

|

ѵ |

ѵ |

|

|

|

|

|

|

|

BD |

ED |

Money, Credit, Banks |

Purpose: The study of theoretical and practical issues of the nature of money, credit, banks. Learn the essence of money, their functions, learn the concepts of money circulation, money circulation, monetary system. To be able to put into practice the concepts, principles and theory of money, credit and banks. Contents: Essence and functions of money. Money turnover, money circulation and monetary system. Loan capital, interest and credit. Types of credit institutions. Non-bank credit institutions, content and types. Functions and operations of the National Bank of the Republic of Kazakhstan. Commercial banks, their functions and organization of activities. International monetary and credit institutions. |

5 |

|

|

|

ѵ |

ѵ |

|

|

|

|

|

|

||

|

BD |

ED |

Monetary Regulation of the Economy |

Purpose: to study the fundamentals of theory and practice in the field of monetary relations, the formation of a system of knowledge among students about monetary regulation as an integral part of the economic policy of the state. Formation of a complex of educational, developmental and educational tasks to achieve the goal. Contents: The essence of monetary regulation and the basis of its organization. The place of monetary regulation in the state regulation of the economy. Theoretical foundations of monetary policy. Instruments of monetary regulation. The role of the banking system in the regulation of inflationary processes. The role of the balance of cash income and expenditures of the population in the management of cash circulation. Monetary regulation in foreign countries |

|

|

|

ѵ |

ѵ |

|

|

|

|

|

|

|||

|

BD |

UC |

Accounting |

The purpose of studying the discipline is to master the basic principles of accounting, consideration of elements and methods of accounting, elements and forms of financial statements, theoretical and methodological foundations of accounting. Contents: Accounting in the organization's management system. The subject and method of accounting. The balance sheet.Billing system and double entry. Organization of document flow in accounting. Cash accounting and investments. Accounting of accounts receivable. Inventory accounting. Accounting for long-term assets. Accounting for the obligations of the organization. Accounting of capital and reserves. Accounting of income and expenses. Preparation and presentation of financial statements |

4 |

|

|

|

ѵ |

|

|

|

ѵ |

|

|

|

||

|

BD |

ED |

Statistics |

Objective: to study the methodology: general principles, methods, methods of collecting, processing and analyzing statistical data, studying regularities and trends in the development of mass social phenomena and processes, their quantitative characteristics. Contents The subject and tasks of statistics. Statistical observation. Statistical summary grouping. Absolute and relative values. Meters of average values and indicators of variation. Selective observation. Rows of dynamics. Indexes. Index method of analysis of dynamics factors. Statistical study of the relationship of socio-economic phenomena. Interval is the relationship between proportional variables. Population statistics. Statistics of labor resources. The system of national accounts, the main macroeconomic indicators. Statistics of the standard of living of the population. |

4 |

|

|

ѵ |

|

|

|

|

|

|

|

|

||

|

BD |

ED |

FundamentalsofAuditing |

The purpose of mastering the discipline is to consistently disclose the theoretical, organizational, methodological and practical foundations of professional audit at the micro level, taking into account the sectoral and regional characteristics of the activities of economic entities in a market economy. Contents Theoretical foundations of audit. Materiality in the audit. Audit risks. Audit evidence and documentation. The internal control system (ICS) and its elements. The scope and planning of the audit. Audit report. Audit of the procurement cycle. Audit of the production cycle. Audit of the implementation cycle and the formation of financial results. Audit of funds. Audit of long-term assets. Audit of liabilities and capital. |

|

|

ѵ |

|

|

|

|

|

|

|

|

|||

|

33

34

35

36

37

38

39

|

Publicfinancemodule |

BD |

ED |

ModernFinancialInfrastructure |

Purpose: Formation of a holistic view of the functioning of the modern infrastructure of financial markets, knowledge of the types, forms and practical application of financial instruments of the infrastructure of financial markets. Contents: Financial markets and their role in the economy of the state. money market infrastructure. Activities of banks in financial markets. Development of the foreign exchange market. Derivative financial instruments and their infrastructure. Infrastructure of the insurance market. Pension market of Kazakhstan. Stock Exchange. OTC stock markets. State regulation of the financial market and financial organizations. Development of the world financial market and its participants. Risk management in financial markets |

4 |

|

|

|

|

ѵ |

|

|

|

|

|

|

|

BD |

ED |

InternationalFinance |

Purpose: students a basic understanding of international monetary and financial relations, the structure of financial markets and their participants, to introduce the basics of pricing of financial instruments, as well as to introduce the tools of analysis and empirical verification of the basic concepts of modern financial theory. Contents: Introduction to International Finance. The international monetary system. Balance of payments. International capital movement. International credit. International financial markets. The structure of global financial markets, such as the debt market. The foreign exchange market. Stock market (stock market instruments, the procedure for issuing shares and depositary receipts, the basics of portfolio theory). |

|

|

|

|

ѵ |

|

|

|

|

|

|

|||

|

BD |

ED |

State Financial Regulation of the Economy |

Purpose: Study of theoretical, methodological and practical issues, including new trends in the development of state and municipal finance. Ensuring the breadth of economic thinking in the areas of state regulation of socio-economic development. Contents: The concept of state financial regulation of the economy, its necessity. Preconditions and conditions of financial regulation. Direct and indirect impact on reproduction. Classification of financial regulation of the economy. Macroeconomic balance and the role of finance in its provision. Multiplier of expenses, taxes, balanced budget. Fiscal policy options in Keynesian equilibrium models in the concept of monetarism and "supply- |

5 |

|

|

|

ѵ |

ѵ |

|

|

|

|

|

|

||

|

BD |

ED |

InstitutionalFinance |

Purpose: formation of a systematic understanding of the functioning of the main financial institutions at the national and international levels, taking into account the specifics of financial instruments. Contents: Institutions and their role in the economy. Basic categories of institutionalism. Organization and structure of the financial market. Infrastructural organizations of the financial market. Regulation of the activities of financial institutions. Types and classification of financial instruments. General issues of organization and functioning of the banking system. Insurance market. Non-state pension funds in the financial market. Mutualinvestmentfundsas a mechanismforcollectiveinvestment. |

|

|

|

ѵ |

ѵ |

|

|

|

|

|

|

|||

|

BD |

ED |

CorporateFinance |

Purpose: the formation of students' practical skills in organizing and managing the finances of corporations, making financial and investment decisions in their activities. Contents: Examines the main theories of corporate finance and the structure of assets, capital and liabilities of corporations, the sources of their formation. Explores the main, investment and financial results of corporations, expenses and incomes, sources of financing of corporations. It provides an opportunity to assess the financial condition of corporations and financial stability, as well as how to manage corporate risks. |

6 |

|

|

|

|

|

|

|

|

ѵ |

|

|

||

|

BD |

ED |

Student'sScientificResearchWork |

The purpose of the student's research work is to master the technology of research activities and its conceptual apparatus; teaching students how to use the knowledge gained in the study of fundamental and special disciplines, the formation of professional competencies in the field of research. Contents. Introduction to the discipline. Intellectual activity. Scientific research. Methodology of scientific research. Preparatory stage of research work. Basic methods of searching for scientific information for translation research. Methods of working on the research manuscript, features of preparation and design. Methodology for preparing a report and presentations. Grant Application Preparation Methodology |

|

|

|

|

|

|

|

|

ѵ |

|

|

|||

|

BD |

ED |

Digitalandfinancialinnovation |

The aim of the course is to introduce students to the basics of digital and financial technologies, their impact on the economy and society, and to develop practical skills in using innovations in this area. Course content: Fundamentals of digital and financial technologies: blockchain and cryptocurrencies; artificial intelligence and machine learning; Internet of things; digital platforms. Innovations in the financial industry: fintech startups and fintech companies, electronic payments and money transfers, digital banks and lending. Analysis of the impact of digital and financial innovations on the economy and society |

|

|

|

|

|

|

ѵ |

|

ѵ |

|

|

|||

|

|

UC |

IndustrialРractice І |

The purpose of the first work practice is: to consolidate the theoretical knowledge gained during a given period of study at the university, to gain experience in organizations, second-tier banks, enterprises and departments, financial and economic departments of state and non-state institutions. Content. The first production practice is carried out within the time frame corresponding to the curriculum. Students do internships at enterprises with which the university administration has an agreement. These can be enterprises of any form of ownership, banks, insurance companies, government agencies. The duration of the practice is determined by the schedule of the educational process. Before the practice, the department holds an introductory conference to clarify the purpose, objectives and content of the practice. Each student is given a program, a schedule and an individual task. |

4 |

|

|

ѵ |

|

|

|

|

|

|

ѵ |

|

||

|

40

41

42

43

|

FinancialMathematicsModule |

BD |

ED |

FinancialSociodynamics |

The goal is to understand the relationship between social processes and the financial system, as well as to identify trends and patterns that affect financial markets. Contents: Study of the relationship between socio-economic processes and financial markets. Analysis of the influence of political, social and cultural factors on economic growth and the stability of financial markets. Consideration of the emotional and psychological factors that influence the financial decisions of investors and market participants. The study of methods and tools of social analysis and their application for forecasting financial markets and the development of the economy as a whole. |

4 |

|

|

ѵ |

ѵ |

|

|

|

|

|

|

|

|

BD |

ED |

FundamentalsofFinancialComputing |

The purpose of studying the course is to give a holistic concept of quantitative financial analysis of the conditions and results of financial, credit and commercial transactions related to the provision of money in debt. Contents Subject and method of financial calculations. Simple interest. Simple interest. Equivalence of interest rates. Consolidation of payments. Permanent financial returns. Variable financial rents. Conversion of financial rents. Risk and diversification. Repayment of long-term loans. Efficiency of financial operations. |

|

|

ѵ |

ѵ |

|

|

|

|

|

|

|

|||

|

BD |

ED |

FinancialMathematics |

The purpose of the course is to master the quantitative analysis of financial transactions, methods and techniques of financial and economic calculations, as well as the development of algorithms for conducting financial transactions. Course content: Mathematical models of financial instruments, including stocks, bonds, futures, options and other instruments. Various mathematical methods and tools used in financial mathematics, including stochastic processes and numerical analysis methods. Practical application of mathematical methods in the context of financial problems, including calculations and analysis of results. Studying the technique of financial and economic calculations, including methods for calculating profitability and depreciation. |

5 |

|

|

ѵ |

ѵ |

|

|

|

|

|

|

|

||

|

BD |

ED |

FinanceStatistics |

The aim of the course is to introduce students to the basic concepts and methods of statistics used in the financial sector, as well as to develop skills in the analysis and interpretation of financial data using statistical tools. The content of the course includes the study of the basic concepts of statistics, descriptive and inferential statistics, regression analysis, time series analysis and statistical modeling in the context of processing and analyzing real financial data. |

|

|

ѵ |

ѵ |

|

|

|

|

|

|

|

|||

|

44

45

46

47

|

Tax and banking system module |

BD |

ED |

Banking |

Purpose - to study the features of the functioning of the modern banking system; get acquainted with domestic and foreign methods of banking services; learn the skills of drafting loan agreements, as well as other documents. Acquire a holistic approach to aspects of banking in order to develop professional skills. Content. Features of the creation, licensing and activities of commercial banks. Management of banking capital and the formation of banking resources. Deposit portfolios of commercial banks. Non-deposit sources of banking resources. Business of commercial banks with securities.Loan portfolio and problem loans management. Features of banking marketing. |

6 |

|

|

|

|

|

|

ѵ |

|

|

|

|

|

BD |

ED |

The Organization of Banking Activities |

Purpose.The study of the basics of analysis of banking operations for the formation of professional skills of specialists to assess the activities of commercial banks based on various financial indicators, mastering the methods of further effective management of commercial banks. Contents. Legislative bases of banks' activity in the Republic of Kazakhstan. The content and essence of macroeconomic regulation of commercial banks. Sources of formation of banking resources. Passive operations. Management of the bank's own capital. The deposit guarantee system of the Republic of Kazakhstan. Foreign economic activity of commercial banks. Leasing, foreign exchange and off-balance sheet operations of commercial banks. Managing the liquidity of a commercial bank. Analysis of financial results of a commercial bank. Banking supervision. |

|

|

|

|

|

|

ѵ |

|

|

|

|

|||

|

BD |

ED |

TaxesandTaxation |

The purpose of the discipline: the formation of students' basic skills on the calculation of taxes of business entities and the population. Content of the discipline: Taxes, basics of taxation. Property tax. Transport tax. Land tax. Value added tax. Excises. Gambling tax. Fixed tax.Corporate and individual income taxes.Features of taxation of income of foreign legal entities and individuals.Social tax.Taxation of subsoil users. Special tax regime. Fees, duties and payments. Tax control. |

6 |

|

|

|

|

|

ѵ |

|

|

|

|

|

||

|

BD |

ED |

Theory and Organization of Tax |

The purpose of the discipline: the study by students of the historical and theoretical position of the emergence and development of taxation Contents of the discipline: The origin of practice and stages of development of taxation. Fiscal authorities in the history of taxation in Kazakhstan. Basic theories of taxation. Classification of taxes, functions and principles of taxation. Elements of the legal composition of taxes. Formation and development of the tax system of the Republic of Kazakhstan. Tax administration. Fundamentals of building tax authorities. Theoretical foundations for the formation of an effective tax policy |

|

|

|

|

|

ѵ |

|

|

|

|

|

|||

|

48

49

50 |

Institutionalfinancemodule |

BD |

ED |

FundamentalsofInvestmentManagement |

The purpose of the course is to develop students' modern fundamental theoretical knowledge of investment management, development of practical skills in making managerial decisions in the field of investment. Content: Classifies investment processes and investment management mechanisms. Gives an idea of organizational and economic activities in the field of private and public investment management in the face of changing external and internal investment environment of the state and organizations. Develops practical skills in making managerial decisions in the field of investment. |

5 |

|

|

|

|

|

|

|

|

ѵ |

|

|

|

BD |

ED |

Investment and Financial Decisions Corporations |

Purpose: Formation of a conceptual, fundamental model for the analysis of the entire complex of financial decisions of a corporation among students, and equipping them with scientific and practical knowledge in the field of investment. Contents: Modern methods for evaluating the effectiveness of investments in real and financial assets, risk assessment, asset portfolio management under conditions of uncertainty and risk; determining the price of capital, basic theories of capital structure, methods and procedures for evaluating companies in mergers and acquisitions. Growing and discounting. Interest, interest and discount rates. Formation and evaluation of the company's investment program. Methodsforassessingthecommercialeffectivenessofinvestmentprojects |

|

|

|

|

|

|

|

|

ѵ |

|

|

|||

|

PD |

UC |

IndustrialРractice ІI |

Forms practical skills in financial analysis of business projects of enterprises, conducting a full cycle of the credit process in second-tier banks, tax administration of organizations and institutions. It instills the skills of managerial tasks in a particular enterprise or in an organization corresponding to the profile of the specialty. |

7 |

|

|

ѵ |

|

|

|

|

|

|

ѵ |

|

||

|

51

52

53

54

55

56

57

58 |

Financialmanagementmodule |

BD |

ED |

GlobalChallengesBehavioralFinance |

The purpose of studying the discipline is to form students' practical skills in the process of making financial decisions in conditions of global instability and that decision-making is not always based on the results of a rational analysis of available information. The content of the discipline teaches the process of making financial decisions in real conditions, the search for rational financial decisions in conditions of unpredictable and high risks. Generates projections of risk assessment and probability of investment alternatives. Diversifies the choice of investment opportunities. Studies the importance of permanent benefits and the impact of sustainable financial resources during the global crisis |

5 |

|

|

|

|

|

|

|

|

ѵ |

ѵ |

|

|

BD |

ED |

FinancialManagement |

Purpose: in-depth formation of theoretical knowledge on the basics of financial management, training in the ability to combine theory and practice. Contents: basic concepts and categories of financial management.Assessment and management of corporate risks. Methods of asset valuation. Cost-based, profitable and market-based approaches to assessing the value of a company. Cost of financing sources and capital structure. Management of current assets and short-term liabilities.The policy of attracting debt and equity capital.Corporate reorganization.. |

|

|

|

|

|

|

|

|

ѵ |

ѵ |

|

|||

|

PD |

ED |

The Financial Environment of Business and Financial Risks |

Purpose: to study the business environment, the ability to analyze business risks, make optimal decisions to minimize them. Contents: Entrepreneurial environment: essence and types.Theory of entrepreneurial risks, essence, types, classification. Methods for assessing entrepreneurial risks.The organization's risk management system.Methods for optimizing losses from risks.Anti-crisis risk management.The risk of bankruptcy of the organization as the main manifestation of financial risks.Economic - statistical methods of risk assessment.Qualitative and quantitative risk analysis |

5 |

|

|

|

|

|

|

|

|

|

ѵ |

|

||

|

PD |

ED |

VentureFinancing |

Purpose: to provide knowledge about the theoretical and practical basics of managing the attraction and use of appropriate venture financing strategies. Content: Theoretical aspects of venture capital. Venture business and its structure. The concept of venture investment. Ethical aspects of venture financing. Evaluation of an innovative company and the share of a venture investor in the company. Venture business performance management, cash flow modeling. Informal venture capital market. Experience and prospects of venture business development in Kazakhstan. |

|

|

|

|

|

|

|

|

|

ѵ |

|

|||

|

PD |

ED |

FinancialControlandAudit |

The purpose of the discipline is to teach students to correctly understand and interpret financial information, financial categories, the degree of impact of financial control and audit on economic processes. Know the basic norms and principles of legal regulation of state control activities in the field of finance. Content of the discipline. Teaching students goals, objectives, general approaches to methods, principles of financial control at all levels of management, methods of financial control and audit; mastering by students of the main approaches to the organization of financial control and audit, norms regulating budgetary, tax, currency relations. |

5 |

|

|

|

ѵ |

|

|

|

|

ѵ |

|

|

||

|

PD |

ED |

Treasury execution of the state budget |